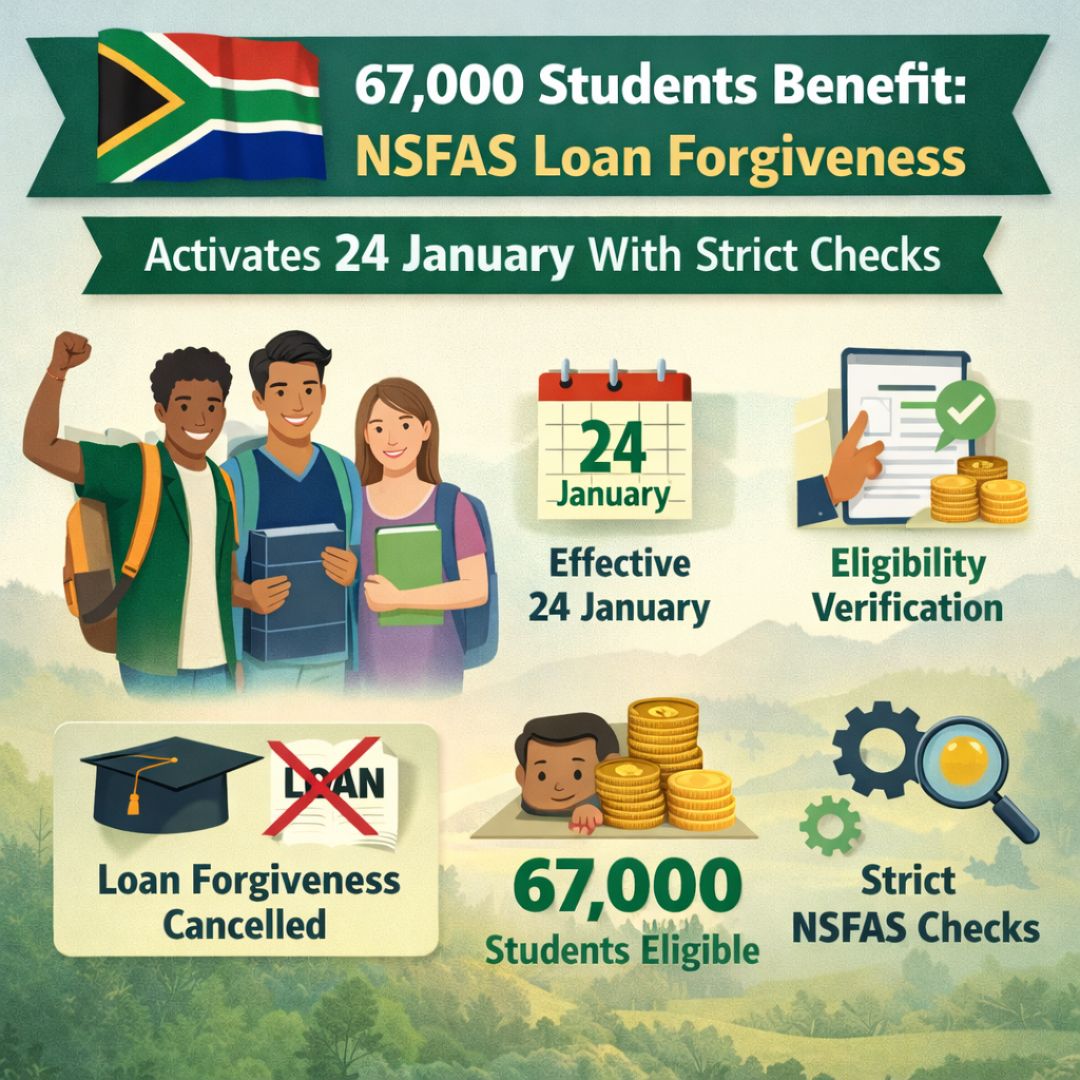

Thousands of students across South Africa are set to receive major financial relief as NSFAS loan forgiveness officially activates on 24 January. The initiative targets former beneficiaries who completed their studies and met specific post-study requirements, easing long-standing repayment pressures. With around 67,000 students expected to benefit, the process introduces strict verification checks to ensure fairness and accountability. For many young graduates facing unemployment or low income, this development marks a turning point, offering breathing space while reinforcing responsible use of public funds within the country’s higher education system.

NSFAS loan forgiveness rollout begins nationwide

The NSFAS loan forgiveness programme has been carefully structured to support graduates who upheld their obligations after qualifying. Authorities stress that strict verification checks will be applied to prevent misuse, with academic records, employment data, and prior funding history all reviewed. Only those who met funding conditions and contributed through work or service will qualify. The goal is to reward compliance while protecting limited education resources. Officials describe the process as a balance between compassion and control, ensuring that public funding integrity remains intact while delivering targeted graduate relief to deserving individuals navigating tough economic realities.

How NSFAS forgiveness eligibility rules affect students

Eligibility for the forgiveness scheme is not automatic, and students are urged to understand the criteria clearly. NSFAS will focus on completed qualification status, verified income thresholds, and adherence to funding contracts. Graduates who dropped out or breached agreements may be excluded. The checks aim to ensure fair access controls while prioritising those who followed the rules. For many, this clarity reduces anxiety and encourages accountability. By applying income-based assessment measures, the programme supports social mobility without opening the door to abuse or unequal treatment.

SASSA Bonus Grant 2026: Payment dates amount rules and eligibility checks beneficiaries must follow

SASSA Bonus Grant 2026: Payment dates amount rules and eligibility checks beneficiaries must follow

Students gain relief as NSFAS checks tighten

While the forgiveness brings welcome relief, the tightened oversight signals a new era of accountability. NSFAS emphasises data cross-checking systems to confirm employment and earnings, limiting fraudulent claims. Students who qualify may see balances cleared automatically, reducing administrative delays. This approach delivers timely debt clearance while maintaining transparency. For beneficiaries, the relief can unlock future opportunities, from improved credit standing to reduced stress. At the same time, accountability measures applied reassure taxpayers that funds are managed responsibly and sustainably.

What this NSFAS forgiveness move means long term

In the bigger picture, the loan forgiveness activation reflects a shift in how South Africa supports graduates beyond graduation. By combining relief with controls, the system promotes responsible funding culture while addressing unemployment realities. Students benefit from reduced debt pressure, and institutions gain trust in funding sustainability. Over time, this could strengthen confidence in public aid schemes and encourage higher completion rates. If managed well, the approach may create long-term graduate stability, ensuring education funding continues to empower future generations without compromising fiscal responsibility.

| Category | Requirement | Status |

|---|---|---|

| Beneficiaries | Former NSFAS-funded students | 67,000 targeted |

| Activation Date | Forgiveness processing starts | 24 January |

| Eligibility | Completed qualification | Mandatory |

| Income Check | Below set threshold | Verified |

| Verification | Academic and employment data | Strictly enforced |

Frequently Asked Questions (FAQs)

1. Who qualifies for NSFAS loan forgiveness?

Graduates who completed funded studies and met all NSFAS conditions may qualify.

SASSA SRD payment dates January 2026: What to expect eligibility checks and status tracking steps

SASSA SRD payment dates January 2026: What to expect eligibility checks and status tracking steps

2. When does the forgiveness process start?

The loan forgiveness checks and processing begin on 24 January.

3. Do students need to apply manually?

No, eligible accounts are assessed automatically through NSFAS systems.

4. What happens if a student does not meet the criteria?

Non-qualifying students will retain their loan obligations under existing rules.