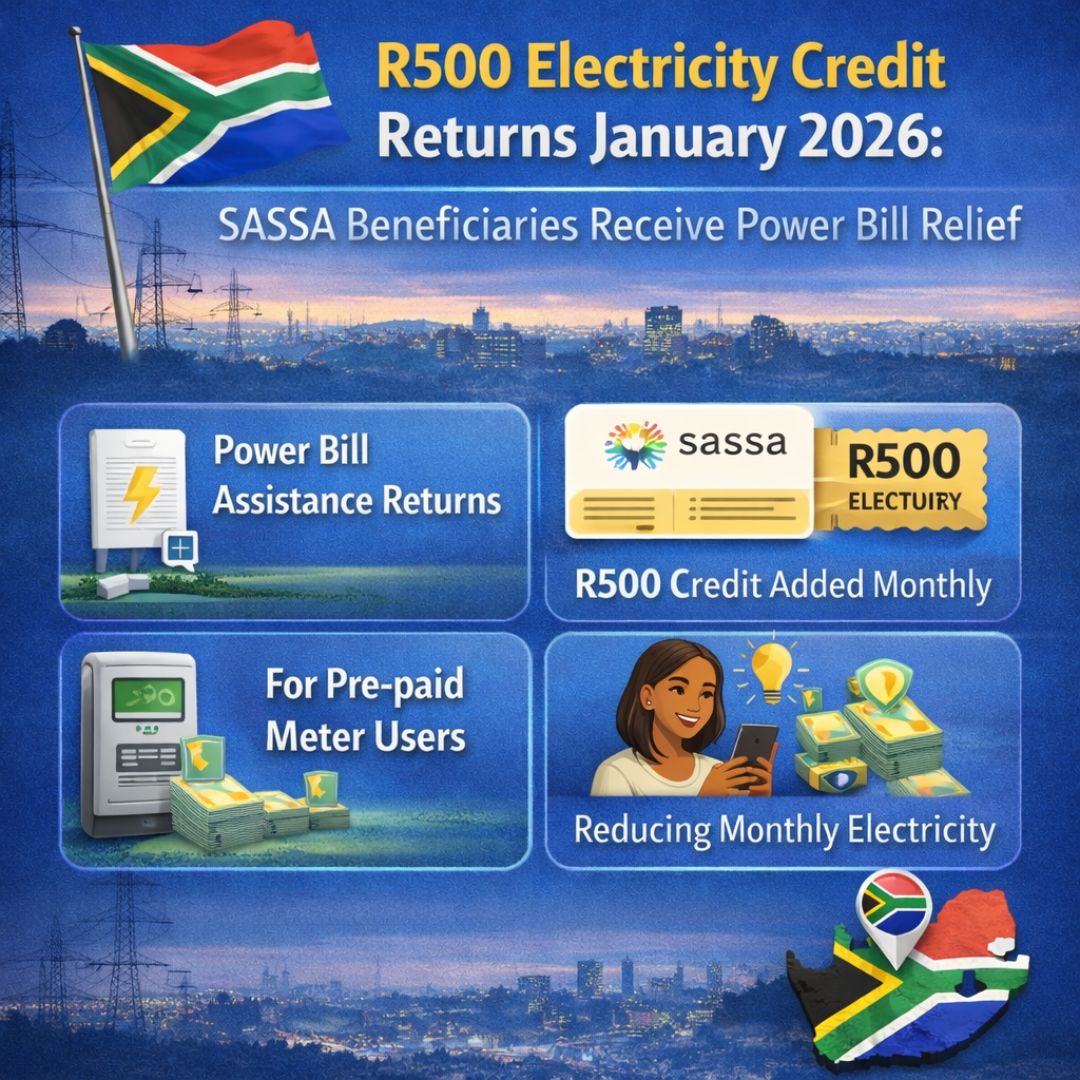

South Africans will receive another R500 electricity credit this month. The program helps vulnerable households manage their financial difficulties and offers relief as living expenses keep increasing. People who get support from the South African Social Security Agency (SASSA) should note that 15 January 2026 is when eligible recipients can access the credit. This program demonstrates the government’s ongoing commitment to supporting people who need assistance and ensures that everyone can afford essential services like electricity.

Understanding the R500 Electricity Credit Program

The R500 electricity credit is a government initiative aimed at helping SASSA beneficiaries manage their energy costs. This program was introduced to relieve the financial strain on low-income households as electricity prices continue to fluctuate. Its purpose is to ensure that families can cover essential living expenses by providing this targeted support. The credit is automatically applied to the accounts of registered SASSA beneficiaries and is specifically intended for electricity payments. To be eligible, beneficiaries must have an active SASSA status in good standing.

| Month | Electricity Credit Value | Eligible Recipients |

|---|---|---|

| January | R500 Credit | SASSA Grant Beneficiaries |

| February | R500 Credit | SASSA Grant Beneficiaries |

| March | R500 Credit | SASSA Grant Beneficiaries |

| April | R500 Credit | SASSA Grant Beneficiaries |

| May | R500 Credit | SASSA Grant Beneficiaries |

| June | R500 Credit | SASSA Grant Beneficiaries |

| July | R500 Credit | SASSA Grant Beneficiaries |

How to Access Your R500 Electricity Credit

Receiving the R500 electricity credit is straightforward for those who qualify. The main requirement is being a SASSA beneficiary. Once eligibility is confirmed, the credit is automatically added to the beneficiary’s account, eliminating the need for additional forms or separate applications. To ensure smooth access, keep your SASSA account information updated and check with your electricity provider to confirm that the credit has been applied. If there are any issues, contact SASSA for assistance. It is important to use the credit wisely to cover your electricity needs for the entire month.

The Impact of the Electricity Credit on Households

The reinstatement of the R500 electricity credit has a significant effect on South African households experiencing financial hardship. For many families, this credit can determine whether they maintain access to electricity or risk disconnections due to unpaid bills. Beyond financial relief, it allows households to allocate their limited funds to other essential needs such as food, healthcare, and daily living expenses. By reducing financial pressure, the credit ensures ongoing access to electricity, a fundamental necessity in modern life.

| Step | Action Needed | Expected Outcome |

|---|---|---|

| 1 | Verify Your Eligibility | Ensure you qualify for the credit before proceeding |

| 2 | Update Your Personal Information | Avoid processing delays or errors with your credit |

| 3 | Check Your Payment Records | Confirm the credit has been successfully applied |

| 4 | Contact SASSA for Assistance | Quickly resolve any issues or discrepancies |

| 5 | Request Extra Support if Needed | Receive guidance to handle any challenges effectively |

Steps to Ensure You Receive Your Electricity Credit

To secure your R500 electricity credit, follow a few key steps. Being proactive helps prevent delays or issues:

– Verify that you meet the eligibility criteria and that SASSA has your correct personal details.

– Regularly review your electricity bills to confirm the credit has been applied.

– Ensure your contact details and bank information are current with SASSA.

– If the credit is not reflected in your account by the expected date, contact SASSA immediately.

– Seek additional support from community groups or online resources if needed.

Other Support Resources for SASSA Beneficiaries

While the R500 electricity credit offers meaningful relief, SASSA beneficiaries have access to additional support to manage monthly expenses and strengthen financial stability. These resources include:

– Food parcels and meal vouchers for households facing severe financial challenges.

– Healthcare services at government clinics and hospitals.

– Educational assistance for children in low-income households through various programs.